Tired of password resets, data breaches, and fake accounts?

UnbreakableID gives you (and your users) digital identities that are secure, private, and truly yours.

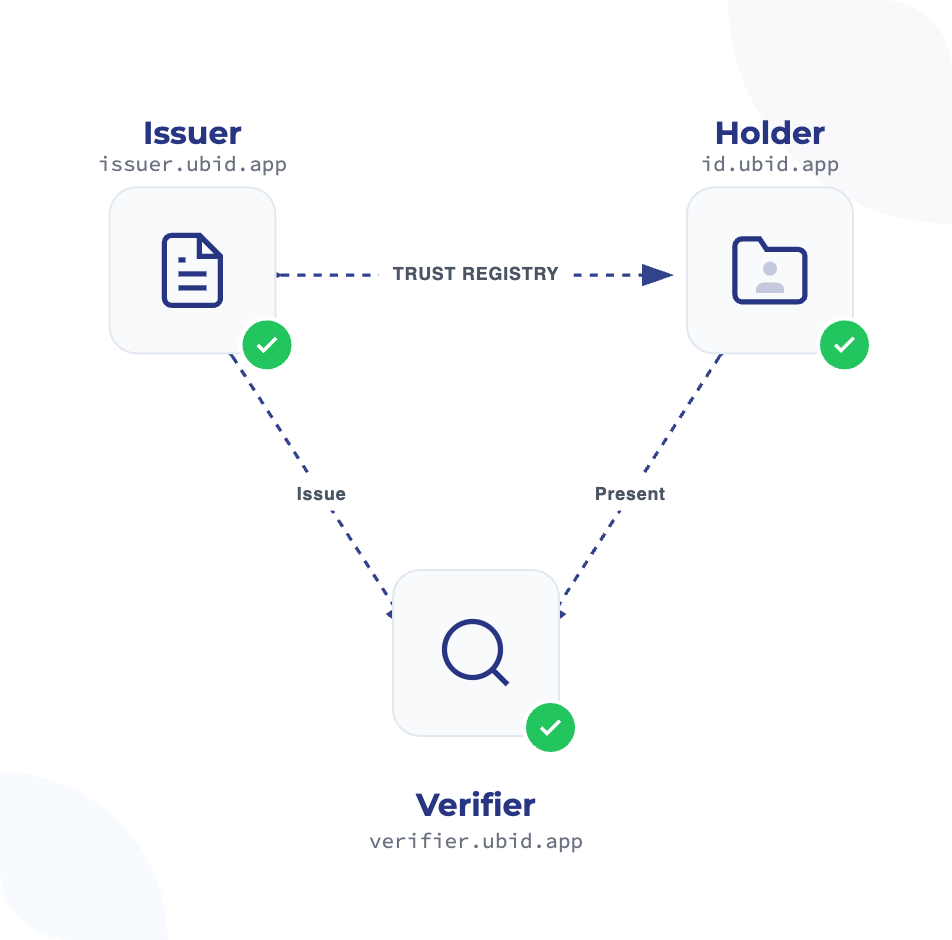

UnbreakableID is built on three pillars that ensure trust, security, and privacy at every step.

Institutions create and issue digital credentials with an unbreakable digital signature, like a tamper-proof notary stamp. This ensures the origin of every piece of data.

A secure personal wallet where users store and manage their digital credentials with full control. No data is shared without explicit consent.

Applications verify identity instantly, without exposing sensitive data or compromising privacy, using advanced math that lets someone prove a fact (e.g., ‘I’m over 18’) without revealing any extra personal details.

From financial services to public institutions, UnbreakableID powers secure identity across industries.

Fraud-proof authentication for accounts and transactions, protecting users and institutions in real time.

Verify ticket ownership instantly and enable seamless, secure entry for concerts, sports, and conferences.

Identity-backed subscriptions that prevent fraud and ensure premium content reaches verified audiences.

Secure login and account recovery with credentials that cannot be forged or stolen.

Trusted citizen access to e-government services, reducing fraud in benefits, permits, and official records.

Authenticate students and staff for enrollment, exams, and campus services with privacy-preserving credentials.

Integration is simple, fast, and flexible. Developers can build with confidence using our comprehensive toolset designed for modern stacks.

Native libraries for TypeScript, JavaScript, Python, and Java.

Powerful endpoints for custom workflows and complex issuance logic.

Rapid prototyping environments with pre-configured templates.

Whether you’re opening a bank account, proving your age, or accessing public services, UnbreakableID makes identity simple, secure, and built to protect what matters most.

Your credentials can’t be faked or altered. If anyone tries to change them, they stop working instantly — so you can trust what you share is always genuine.

You stay in control of your information. Need to prove you’re over 18? Show just that fact, without revealing your full birth date or anything else.

No single point of failure means no mass data leaks. UnbreakableID’s design makes large‑scale breaches mathematically impossible, keeping your identity secure everywhere.

Institutions gain more than security — they gain trust, compliance, and long-term resilience.

Built to meet Know Your Customer (KYC), Anti Money Laudering (AML) rules, plus GDPR data privacy requirements.

Prevent account takeovers, credential stuffing, and subscription fraud effectively.

Seamlessly integrates across fintechs, banks, universities, and government portals.

SDKs and APIs designed for rapid deployment without disrupting legacy systems.

Build credibility by offering privacy-preserving, fraud-resistant identity solutions.

Blockchain-based PKI ensures resilience beyond traditional certificates.